It sure seems like families of dead celebrities fight a lot. And the battles are sometimes over not a lot. Like who should administer the dead celebs’ estate.

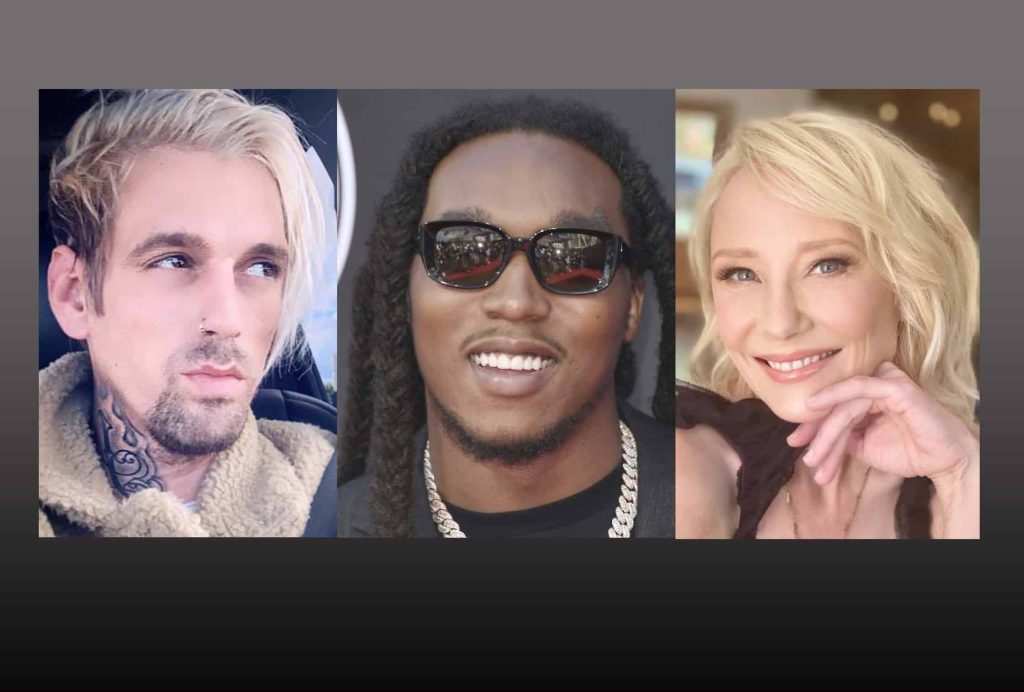

Take rapper Takeoff and actress Anne Heche (who we’ve written about once or twice already).

Dead Celebs New Disputes

In both estates, there’s a dispute over who would control the administration. For Heche’s estate, her son Homer, 20, filed to be administrator. Her former boyfriend James Tupper said not so fast. He objected, saying Homer was not suitable because he’s too young and was being unfair to his half-brother, Atlas (Tupper’s son). The judge in the case recently ruled that Homer could remain administer because Tupper’s evidence was insufficient to prove Homer couldn’t do the job.

Takeoff died of gunshot wounds in Houston on November 1 at age 28. His estranged parents — Titania Davenport-Treet and Kenneth M Ball – are vying over which one of them will administer his estate.

Disputes over estate administrators often baffle us. Acting as estate administrator (also called “executor”; or, in Arizona, “Personal Representative”) is a job, not an honor. And you don’t get to decide who gets what. Estate distribution follows well-established rules: the money goes the same way regardless of who ends up in control.

State Laws Governs

In both Heche and Takeoff’s cases, state law governs their estates’ distributions. Neither one of them had a will (assuming Heche’s emailed “will” is not valid). That means they died “intestate,” and the intestacy rules in each state try to approximate what a decedent might have wanted had he or she created an estate plan. The basics don’t vary much from state to state. Heche lived in California; she was not married, so her estate will be divided 50-50 between her two kids. Takeoff’s home base was Georgia. He was not married and had no children, so his estate will be distributed half to each of his parents, even though they can’t stand each other. Even if he couldn’t stand one or both of them.

Similarly, late musician Aaron Carter died unmarried and without a will. Under California law, his year-old son, Prince, will inherit. The headlines that say his family will not fight the distribution are silly. Paternity is undisputed, so there’s nothing to fight about.

Everyone, even loved ones of dead celebs, have to follow these rules.

Executor Gets Little Benefit

The only benefit the executor may enjoy is a (usually relatively small) fee. In return, they get a lot of work and often a lot turmoil. If disputes erupt at the very beginning of an estate administration, discord is likely to continue. The losing side of a battle to be executor rarely sits quietly on the sidelines until the estate administration comes to a close.

The fact is, James Tupper had a good idea for Heche’s estate. He proposed that an outside, neutral, third party serve as estate administrator. A third party is often a good idea for ordinary estates, too. It allows professionals to do the work. Although professionals charge a fee, they are often knowledgeable and efficient and have contacts that save time, and sometimes money. And make not mistake: estate administration is work. Administrators must sort out assets, identify and pay creditors, resolve disputes, account for receipts and disbursements, pay taxes, and communicate with heirs effectively—for starters. If a professional does all that, family members can time grieve and heal, and keep an eye on the administration if they choose to. (Full disclosure: Fleming & Curti serves as Personal Representative, so we confess to having a bias.)

It’s not uncommon for estates of dead celebrities to employ outsiders. Aretha Franklin’s family set aside their differences and settled on Detroit attorney Reginald Turner, a longtime friend of Aretha’s, to serve as executor. And Comerica Bank & Trust administered Prince’s estate.

Estates of Dead Celebs Can Be Complicated

Celebrity estates often have elements that make hiring a professional a good idea:

1) They can afford it. The value of Takeoff’s estate is about $28 million. His parents can hire professionals and avoid further inflaming their rift. Anne Heche’s estate value? About $800,000, and that includes an estimated $400,000 in expected income from an upcoming book. That’s a closer call, but the challenges are significant. (See No. 2)

2) There are complicated challenges. Heche’s estate is already facing claims from a former boyfriend who says he loaned the actress money and the owner of the house that went up in flames after the car crash that killed Heche. (She apparently was not under the influence, by the way.) Takeoff’s estate will have to manage ongoing management of his catalogue and copyrights, which requires special expertise. Both Heche and Takeoff likely have digital assets, which also might require special treatment. Takeoff’s estate will owe estate tax, being over the current $12.06 million estate tax exemption.

3) There’s conflict. Conflicts tend not to be resolved after the initial battle. If anything, the losing side gets MORE entrenched and more likely to raise issues. Valid or not, disputes cause delays, cost money, and exact an emotional price. Neutral parties are often better equipped to handle it.

It must be said that a good attorney can guide even the most inexperienced administrator through the challenges that might arise. Even for a complicated estate. But it’s more efficient and a lot less stressful to delegate the job to a pro. The bonus advantage: If things go wrong, the family of the dead celeb can join forces against the professional fiduciary and, just maybe, strengthen their relationships.