Community Property With Right of Survivorship in AZ

Arizona is one of the minority of states recognizing the concept of community property. In Arizona’s version, though, most real estate owned by spouses for many years was titled as joint tenancy with right of survivorship. Why? Because Arizona did not recognize community property with right of survivorship until 1995. Is Community Property with Right […]

A Gift to a Married Couple is a Gift to Both of Them

It’s not uncommon for family members to make a gift to a married couple. Usually, when a generous family member contemplates the couple, they assume that the marriage will continue. It also allows for a doubling of the annual gift tax exclusion amount (the well-known $15,000 figure). But sometimes the gift was really intended to […]

Retirement Benefits and Community Property

Arizona is one of the nine U.S. states operating under the principles of “community property.” The basic premise of community property: assets acquired during the period of the marriage are presumed to belong to the marital community (and thus to the spouses equally). There are lots of qualifications and exceptions, but one issue crops up […]

Husband’s Interest in Trust Not Divided in Divorce Proceedings

AUGUST 22, 2016 VOLUME 23 NUMBER 31 Carl and Debbie (not their real names) were married, and have two children together. After more than a decade together, Carl filed for a divorce in their home state of Massachusetts. In the course of the divorce action, the court was required to divide Carl and Debbie’s assets […]

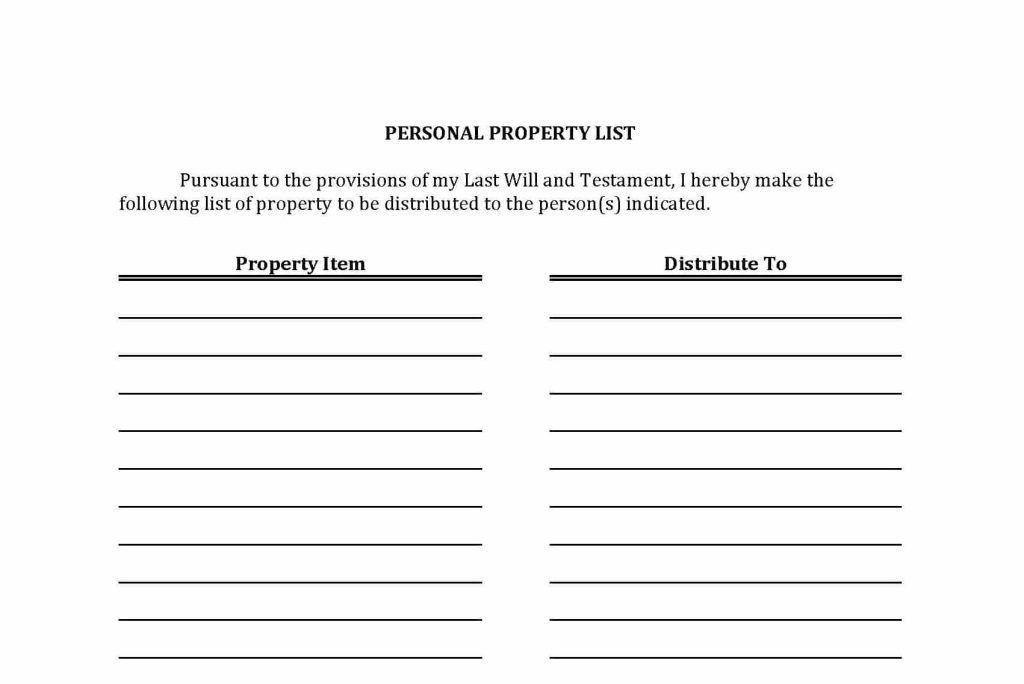

Does Your Personal Property Belong to Your Living Trust?

JULY 21, 2014 VOLUME 21 NUMBER 26 When you create a revocable living trust, you usually want to transfer most (maybe even all) of your assets to the trust — especially if one of the reasons for creating the trust is to avoid the probate process. A new deed to your home, a change in […]

Joint Tenancy with Right of Survivorship, or Community Property?

MARCH 24, 2014 VOLUME 21 NUMBER 12 Which is better? How should we take title to our house? How about our brokerage account? These questions are really common in our practice. The answer is actually pretty straightforward, but we do need to lay a little groundwork. Arizona is a community property state. That means that […]

This is Huge: Feds Publish New Rules on Gay Marriage

SEPTEMBER 2, 2013 VOLUME 20 NUMBER 33 Just a few weeks ago we wrote about some of the uncertainties facing legally married same-sex couples living in states (like Arizona) that refuse to recognize the validity of their marriages. If a legally-married couple moves to Arizona, we wondered, would their ability to receive some of the […]

Simple Estate Planning for a Married Couple

AUGUST 12, 2013 VOLUME 20 NUMBER 30 Last week we saw a married couple in our office. The couple had come to us for estate planning. They did not have children with disabilities, or spendthrift sons-in-law or daughters-in-law. Their assets were not unusual (some Arizona real estate, a brokerage account, several bank accounts). Their net […]

Divorce Case Includes Useful Pointers for Elder Law Attorneys

JANUARY 28, 2013 VOLUME 20 NUMBER 4 At Fleming & Curti, PLC, we don’t spend much time reading appellate decisions about divorce, property division and child support. That’s because we don’t practice family law, and there’s plenty to keep up with in our chosen realms of law. But a recent decision from the Arizona Court […]

Retirement Account Is Community Property But Need Not Be Split Equally

MAY 21, 2012 VOLUME 19 NUMBER 20 Arizona is one of the nine U.S. states which recognize “community property” (a tenth, Alaska, allows couples to voluntarily create community property interests). The other eight community property states: California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington and Wisconsin. Mention community property to a lawyer who has never […]