It may seem like New Year’s was just yesterday, but February is around the corner. This is the last Monday of the month, which is when we like to survey the elder law landscape and share items of interest from the past month. Now that there has been a shift of power in Washington, the major area of interest for the January review is taxes, but there’s also estate planning, celebrity news, and more.

January Review of Tax Talk

First there was the Biden/Harris win. Then came Ossoff and Warnock. The open question is just how much the oh-so-slim Democratic majority can accomplish and if tax policy becomes a priority and if so, when that might be. Biden’s tax plans, if implemented, would have an impact on estate and gift tax. Among other adjustments, he has proposed:

- A decrease in the federal estate tax exemption (now $11.7 million per person) to either $5 million or $3.5 million per person.

- An increase in the top estate tax rate to 45% (now 40%).

- Repealing the basis adjustment (aka “step-up”) on assets at death.

- He has not supported the “wealth tax” proposed by other Democrats.

There’s no shortage of commentary about what is or is not likely to happen. Here are some of the most interesting.

National Law Review: Among “Takeaway Observations” is, “The Biden Plan is a proposal that Biden campaigned on in order to garner as many votes as possible from voters ranging from moderate to liberal. It does not mean, once he is inaugurated, that he will necessarily propose every aspect of the Biden Plan.”

New York Times: “[T]he Biden administration has many things on its agenda ahead of taxes, namely the coronavirus pandemic and its vaccination rollout, as well as shoring up the shaky economy and stabilizing the unequal jobs recovery.

JDSupra: “Mr. Biden is beginning to realize that he may not have the ability to pass legislation that would implement most of his tax agenda. News organizations have started reporting that the President-elect will likely be expanding his focus to include regulatory changes, the effect of which will be to increase estate and gift taxes.”

Biden’s tax plans extend beyond those that affect estates and estate planning; broader looks can be found here, here, and here. And tax-minimizing strategies here and here.

Estate Planning Guidance

There reportedly has been a rush of estate planning during the Covid-19 pandemic. But in a recent survey, more than 45% of those polled confessed they had no estate plan, and only a third said they had a will, which suggests it’s really two-thirds who have no plan.

If you don’t know whether your parents fall into the no-plan group, here are some tips for getting estate planning information from them without seeming greedy. One idea: Do your own estate planning and then parents whether they have taken similar steps.

Further, here are articles that consider specific circumstances for:

- High-net worth women, both generally and with Biden in office.

- Those who don’t plan to have kids.

- Those who have digital assets.

Five Is a Trend

Five appears to be January’s magic number, consider these five:

- Five reasons everyone needs an estate plan.

- Five steps to leaving a remarkable legacy.

- Five Covid-inspired estate planning resolutions.

- Five important estate planning items to sort out.

- Five ways to get your estate in order if your spouse is dying.

Estates of the Rich and Famous

In a not-at-all surprising development, the IRS thinks Prince’s estate is worth twice as much as the executors do and says the estate owes more than $32 million in additional tax. The estate is disputing the deficiency, and a resolution could take years.

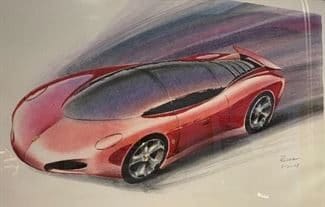

Elia “Russ” Russinoff wasn’t all that rich or famous, but he had a really interesting life and an estate sale to match. He was an artist for General Motors who drew vehicles for four decades. (See image above.) He died in November at 90. The sale is over, but you can still peruse items on the website.

And this podcast looks back at Jack Cassidy, dad of David and Shawn, and how loose ends from a divorce caused problems for his estate.

This and That

Items of interest in elder law are sometimes difficult to categorize; here are a few of those that came up in the January review:

The IRS is proposing charging a $67 fee for obtaining a “closing letter” for estate returns. If you don’t like the idea, here’s where to comment.

Do you know the acronyms associated with Medicare and Medicaid? Here’s a primer.

Seema Verma, the administrator for the Centers for Medicare and Medicaid Services wrote an opinion piece for Newsweek about the need for reforming the nation’s elder-care system. She argues for performance-based nursing home payments. Quote: “Today, a one-star home is paid the same rate as a five-star home. It’s time we start paying nursing homes based on what matters to residents and families: health outcomes as measured by safety and quality of life.”

Did you receive a Covid relief check for someone who has died? You are supposed to send it back. Here’s how.

That’s it for our January review. Stay safe out there.