Elder law isn’t exactly the hot legal topic of the moment, but we’ll still share some of the month’s developments anyway. The June review:

Aging in America

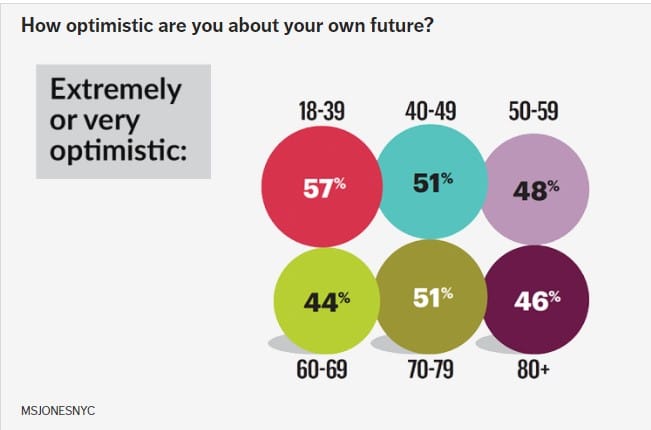

National Geographic and AARP paired up to do a major study of America’s attitudes toward aging. They covered six areas: health, money, happiness, relationships, life stages, and end of life. The result? “Overall, the message was refreshingly positive and reassuring. On the whole, life is good, especially for older Americans.” And, “the people in the study with the most real-life aging experience to draw on — those 85 and up — report that in almost every important category, life worked out just fine.”

In Other Aging News: June 14 was World Elder Abuse Day, and President Biden issued a Proclamation that said, in part: “On this World Elder Abuse Awareness Day, let us recommit to delivering all older Americans the promise of a comfortable and peaceful life with dignity. Let us reaffirm our commitment to a world free from the scourge of abuse and neglect. Let us join the world in celebrating the essential role older adults play in our lives.” And Universal Music is committed to Vera, a new app that “is dedicated to helping dementia patients by creating personalized playlists that stir different parts of the brain and can at least temporarily assist with overall lucidity as well as mood.”

Planning Developments

Get Up to Date: Every estate plan deserves an annual review, but clients usually don’t want to do that. From their point of view, often nothing has changed. But they also should consider what they don’t know. Specifically, changes in the law and planning techniques.

Digitize It: Even though the cryptocurrency market has struggled lately, more people own digital assets than ever. And if cryptocurrency doesn’t bounce back, some other trendy investment will take off (NFTs?). Anyone with such assets should incorporate them into their estate plan. Here’s one of the best articles we’ve seen that explains why and how. Among assets: Social media accounts, and many have different options. Make your wishes known.

Biz Dev: Trusts can be an important tool for business owners to minimize tax, protect assets, and provide for a smooth transition. For some businesses, special real estate valuation rules can help, too.

Maximize Giving: We often talk to clients who have charitable intent about leaving taxable retirement accounts to charity. Here’s a piece that illustrates what we mean.

Surveys Say: A recent survey on the impact of COVID shows that 1 in 5 Americans who died from COVID-19 didn’t have any estate planning. However, the disease did serve as a wake-up call for some. Those who got sick and survived or who were close to someone who did were more likely to get a plan than those who didn’t. Meanwhile, a survey of wealthy investors reflects that many are not on top of their planning.

Planning Potpourri: Learn the A-B-Cs of planning for collectibles and six differences between wills vs. trusts. Confront the challenges of leaving the family vacation home. Explore investment nuances for you and your IDGT, the 5-year rule for IRAs, and how to benefit from portability.

Another View

Earlier this month, we wrote about a New York Times column that gave bad advice about a disappointed child on the receiving end of an unequal inheritance. We said parents can do what they want, and the child should get used to it. Here’s another view: Parents, don’t do it.