November’s Elder Law Items of Interest

Turkey. Done. Pie. Done. Black Friday. Done. Next? December. But first, our review of elder law items of interest from November: Estate & Tax Planning The estate tax exemption will take a relatively big jump in 2023. It increases to $12.92 million per person from $12.06 million in 2022. That’s an extra $860,000 to plan […]

The Problem of the Pretermitted Spouse

One of the common and vexing problems in administering a decedent’s estate is how to deal with a pretermitted spouse. To most non-lawyers, that sounds vaguely disturbing. What is a “pretermitted spouse,” and why do we care about their problems? What – or who – is a “pretermitted spouse”? “Pretermitted” is just a near-archaic term […]

Estate Tax Revenue Jumps for 2021

Something surprising happened in 2021: Estate tax revenue increased. Though the estate tax exemption has never been higher, the amount collected almost doubled from 2020 to 2021, from $9.3 billion to $18.4 billion, recent IRS data indicates. Experts suspect it’s the combination of pandemic death rates and market gains in stocks and real estate. Some […]

Do Not Resuscitate / Do Not Hospitalize / Do Not Intubate (DNR/DNH/DNI)

A client asked last week whether he had properly signed his own DNR and DNI orders. We asked if he meant a “do not resuscitate” and “do not intubate” order. He confirmed that was what he thought he had signed. It made us think we need to look at the advance directive issue and update […]

Halloween Review: Scary? Not so Scary?

Boo. Here’s your Halloween edition of our monthly review of developments in elder law. Some are scary, but others not so much. The IRS: Not So Scary? We may another year to figure out RMDs from inherited IRAs. The SECURE Act changed the payout requirements for a decedent’s IRA, and many were surprised when the […]

Blended Family’s Estate Plan Challenges

Americans are romantically optimistic. People keep getting married, even though almost 50% of marriages end in divorce. Estate planning for second, third, fourth marriages can be delicate, especially if there are children from prior relationships. The “blended family” estate plan has a number of special challenges. Among scenarios to consider: Stepchildren: Just Like My Own […]

Trust Amendment by Email Might Be Valid

Last week we wrote about the late Anne Heche‘s emailed “will” that might be judged valid under California law. Our own article reminded us of a similar, but different, story we recently read about a less-famous electronic estate plan. The key difference: it involved an attempt at a trust amendment by email, rather than an […]

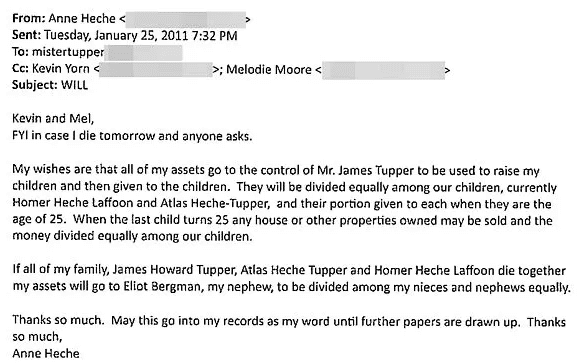

Emailed ‘Will’ at Center of Heche Estate Dispute

Can an emailed will be a will? That’s the question at the center of a dispute between actress Anne Heche’s son and her former significant other. Heche died in August at age 53. Shortly after, her 20-year-old son, Homer Laffoon, petitioned a California court to be named executor to administer her estate and for the […]

What I Learned This Summer

I don’t know about you, but I spent my summer in one continuing legal education program after another. Here’s some of what I learned this summer. What I learned in Alaska OK — I really went to Alaska to see the bears. And they were incredible, and worth the trip. But while I was there, […]

September Review: The Queen and Other Jewels

It’s almost the end of the month, which means it’s time for our monthly review of elder law news and developments. Normally, we survey a broad elder law landscape, but this September review is not normal: Queen Elizabeth has died. That leaves many wondering who inherits her $500 million fortune. So we spend much of […]