Can a beneficiary deed challenge be based on alleged undue influence? Yes, in the same way that a will, a trust, or another writing could be challenged. A recent Arizona appellate decision spelled out some of the rules and details.

But what is a beneficiary deed?

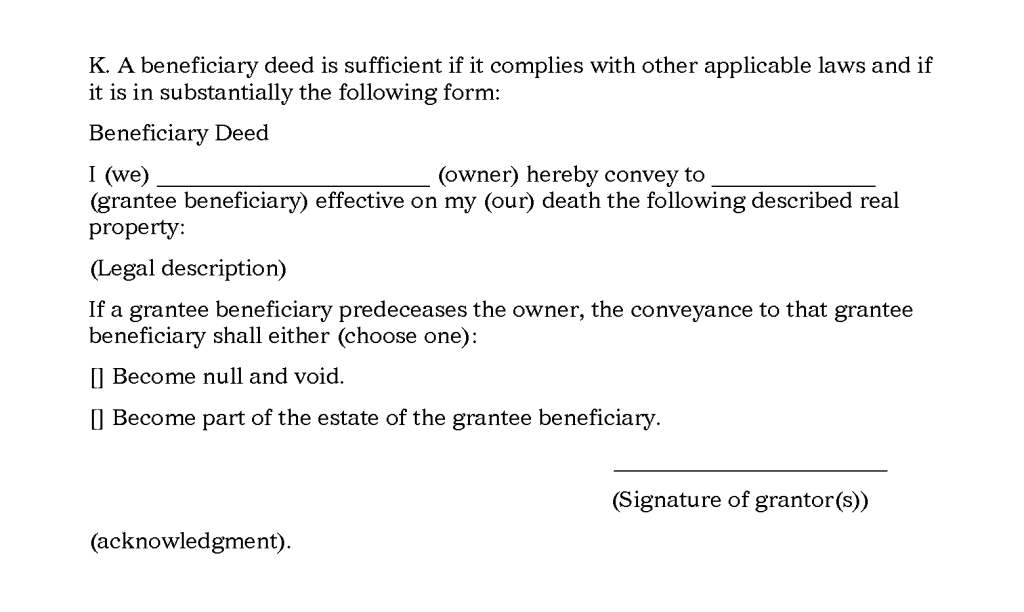

First, a little introduction. Arizona is one of the 60% (or so) of states in which you can sign a deed that becomes effective on your death. Some states call them “TOD” (Transfer on Death) deeds, or revocable TOD deeds. Arizona’s law uses the simpler title: beneficiary deed. We’ve explained the concept before — several times, in fact.

The beneficiary deed is a useful mechanism for probate avoidance, but it’s not the best way to handle every circumstance. A living trust might be more appropriate for some.

But can an unhappy heir challenge the deed? Yes. A beneficiary deed challenge can be based on fraud, duress, mistake — or undue influence. And that brings us to Alex Brandt’s life story.

Alex Brandt’s personal life

Mr. Brandt dated Marilyn Sanders for several years. He proposed marriage, but they never did get married. They lived in California, but he moved to Arizona and bought a home. He also purchased some investment properties, and gave Ms. Sanders an ownership interest.

Several years later the couple broke up. Mr. Brandt moved on to another relationship, with a different Marilyn — this time Marilyn Mishkin. She moved in, he proposed marriage, but they never did get married. Along the way, Mr. Brandt signed and recorded a beneficiary deed naming Ms. Mishkin as beneficiary. But that beneficiary deed did not get challenged.

In 2005 the couple broke up. Mr. Brandt signed a new beneficiary deed — actually, he simply copied his old beneficiary deed, but named his niece Yvette Rosenberg as beneficiary. He recorded the new document — but that’s still not what led to a beneficiary deed challenge.

Three years later, Mr. Brandt and Ms. Sanders reconnected. Mr. Brandt visited her in California (she had moved back after they broke up) and returned her engagement ring from the failed engagement years before. Then the couple began to date again, and ultimately Ms. Sanders moved back to Arizona and moved in with Mr. Brandt.

A few years after that, Mr. Brandt got sick. Ms. Sanders stayed with him and cared for him — cooking meals, taking him to doctors’ appointments. In March, 2017, she took him to the hospital and signed him in. His diagnosis included “memory loss” and “cognitive impairment”.

The final beneficiary deed gets signed

A month after his hospitalization, Mr. Brandt signed a new beneficiary deed. Ms. Sanders was not involved, and he didn’t even tell her about it at the time. A few months later he surprised her on her birthday by giving her the recorded document.

The couple continued living together for almost a year before Mr. Brandt returned to the hospital. This time the medical team decided he was unable to make his own decisions. Mr. Brandt called the police and told them he was being held as a prisoner in the hospital. And, for the first time throughout this story, his family learned of his condition and circumstances.

Mr. Brandt’s niece came from her home in Canada to visit Mr. Brandt. He told her that he was afraid of Ms. Sanders, and that she was trying to kill him so she could steal his assets. He signed a new health care power of attorney naming his sister as agent. And then he was discharged to his home.

Mr. Brandt’s sister took care of him for a week, then left him in his home with Sanders providing care. Mr. Brandt’s sister and niece then returned to their home. Mr. Brandt died three months later.

The beneficiary deed challenge

After Mr. Brandt’s death his sister and niece learned for the first time about his beneficiary deed. The niece challenged its validity, alleging undue influence by Ms. Sanders.

The Arizona probate court heard the beneficiary deed challenge, but granted summary judgment in favor of Ms. Sanders after the niece put on her case. The judge ruled, among other things, that what Mr. Brandt said to his sister and niece long after he signed the beneficiary deed was not admissible in evidence at all.

The Arizona Court of Appeals agreed — but disagreed. The appellate judges acknowledged that a beneficiary deed challenge could be based on undue influence, and that the evidence of undue influence is usually indirect. They cited longstanding Arizona case law that identifies eight elements that might tend to show — and even create a presumption of — undue influence. Then they added a ninth.

The eight (or nine) indicators of undue influence

Referring back to a 1966 Arizona court case, the appellate judges identified these indicia of undue influence for the trial court to consider:

- Fraudulent representations by the beneficiary

- Hasty execution of the document

- Concealment of the execution

- Active involvement by the beneficiary

- Inconsistency with prior declarations

- Reasonableness of the action given circumstances, attitudes and family

- Susceptibility to undue influence

- The existence of a “confidential relationship”

Reviewing those eight indicators, the appellate court agreed that Mr. Brandt’s niece had not shown sufficient evidence of any one. Summary judgment dismissing her claim was appropriate on that basis. But, reasoned the judges, the beneficiary deed challenge should also have considered Mr. Brandt’s post-signing declarations, and his niece should have been permitted to introduce that evidence.

Consequently, the appellate court reversed the summary judgment order and sent the case back to the probate court for further evidence. Even in doing so, however, the appellate decision observes that there was “just enough evidence” to create a factual dispute — and not necessarily enough to support a judgment for Mr. Brandt’s niece. Rosenberg v. Sanders, May 31, 2022.

What’s the lesson in this beneficiary deed challenge?

We always try to find the meaningful lesson in the cases we describe. Several come to mind in Mr. Brandt’s beneficiary deed challenge:

- Mr. Brandt’s estate plan would have benefitted from a lawyer’s involvement. Beneficiary deeds might not have been the best way for him to plan his estate. A good lawyer might have suggested a living trust, along with powers of attorney, a will, and better attention to details. But, and perhaps most importantly, involvement of a lawyer would have provided evidence (admissible in the beneficiary deed challenge) of his actual wishes and thinking.

- Undue influence is notoriously difficult to prove. Even if Mr. Brandt’s family was deeply suspicious of Ms. Sanders’ behavior and involvement, the burden of proving undue influence if a significant challenge.

- One thing Mr. Brandt did very well: he made his decisions without involving his intended beneficiary. That made it easier for her to show that she wasn’t involved, didn’t come up with the idea, and didn’t try to bend him to her own will.