July Review: Aretha, Pop Culture Gifts, and So Long

July is coming to an end and so has my time writing Elder Law Issues newsletters. This is my last review of the prior month’s developments in elder law. New Fleming & Curti associate Matt Mansour and law clerk Jordan Young will be contributing articles instead. Maybe they’ll continue monthly or occasional news reviews. We’ll […]

Mental Health Care Powers of Attorney in Arizona

When people are creating their advance directives, they often overlook one important document– the mental health care powers of attorney. Mental health care powers of attorney (POA) are legal documents that allow a person to make mental health treatment decisions on behalf of another person when they are unable to do so for themselves. The […]

Garn-St Germain and Your Estate Planning

Last week in this space we wrote about Arizona’s beneficiary deed option. The Arizona law allows you to set up an automatic transfer on death for real estate. No probate, no complications. There are things to look out for, of course, but it can work for many people. One thing you should know about: Garn-St […]

Automatic Transfer on Death: Arizona’s Beneficiary Deed

You know that you can name a beneficiary on your life insurance account, your bank and other financial accounts — even your car. Wouldn’t it be great if you could create an automatic transfer on death for your home? Oh, wait — in Arizona, at least, you can. Arizona’s “beneficiary deed” We’ve written about the […]

September Review: Estate Tax Changes Around the Corner?

October is around the corner, which means it’s time for the September review of elder law news and developments. Of utmost concern: Potential changes to the estate tax. We’ll devote most of our review to the current proposal, even though it’s very far from a done deal. Those who might be affected should think about […]

Ademption: Sale of Stock Defeats Inheritance

A will (or trust) often leaves specific items — like stock — to named individuals. But what happens when that specific item no longer exists at the death of the owner? Well, let’s review the concept of “ademption.” What is ademption? The legal concept of ademption is straightforward. But understanding it requires us to first […]

Making Lists: A Good Way to Show You Care

Write it down. For decades, law firms like Fleming & Curti have provided estate planning clients with blank forms for making lists for gifts of personal property. Clients rarely use them, but there are significant benefits to making lists. Lists give your executor (a/k/a personal representative) or trustee a roadmap for distributing the items. In […]

Arizona Advance Directive Registry is Moving

If you signed your health care directives with Fleming & Curti, PLC, in the past decade or so, you probably already know about the Arizona advance directive registry. It gives you an easy — and free — way to store your health care power of attorney, living will or pre-hospital medical care directive online. For […]

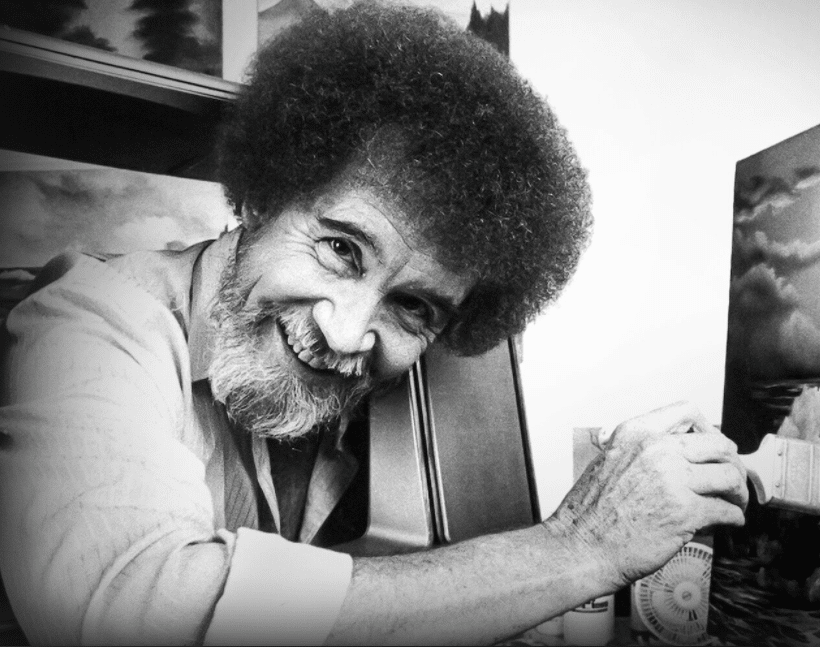

August Review: Taxes, Planning, Aging & Bob Ross

It’s the end of the month, so it’s time for the August review of elder-law related developments. Taxes & Planning Iowa has decided to ditch its inheritance tax, phased out and fully reduced by January 1, 2025. There are only five others: Kentucky, Maryland, Nebraska, New Jersey, and Pennsylvania. Even “Gen Z” needs to know […]

New Visitation Law: Coming Soon for Health Care Agents

In a few short weeks, health care agents will need something extra to protect incapacitated loved ones from upsetting visitors. A court order. Starting September 29, when new laws in Arizona take effect, health-care agents (“HCPOAs”) will be subject to a new visitation law, A.R.S. § 36-3211. New Visitation Law: ‘Encourage and Allow’ Contact The new […]