What To Do About a Child Who Can’t Handle Money

SEPTEMBER 1, 2014 VOLUME 21 NUMBER 31 A reader asks: “could you do an article on how to leave inheritance to a son who is not good at handling money? Should I leave his portion to another son who is good at it? They are very close and would get along.” First we have a […]

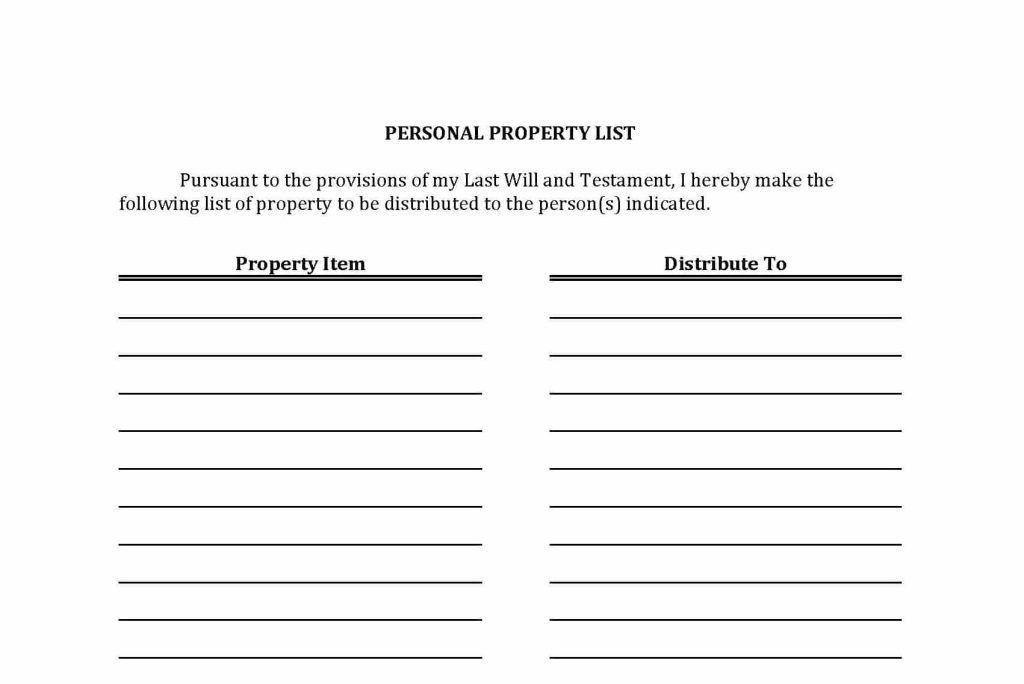

Does Your Personal Property Belong to Your Living Trust?

JULY 21, 2014 VOLUME 21 NUMBER 26 When you create a revocable living trust, you usually want to transfer most (maybe even all) of your assets to the trust — especially if one of the reasons for creating the trust is to avoid the probate process. A new deed to your home, a change in […]

Disinheritance of Adult Child With Disabilities Leads to Lawsuit

OCTOBER 21, 2013 VOLUME 20 NUMBER 40 Suppose you have two children. Your daughter is very capable, very mature, very responsible. Your son has a developmental disability, or a drinking problem, or just problems handling money. What should you do with any inheritance you leave to your son? Put it in a trust? Make your […]

Some Questions We’re Being Asked a Lot Lately

APRIL 29, 2013 VOLUME 20 NUMBER 17 You probably have read that Congress has made big changes to the estate tax system. More accurately, Congress has made “permanent” the big (but piecemeal and temporary) changes introduced over the past decade. We hear a lot of questions from our clients about what those changes mean. Here […]

Estate Planning in 2013 — Is It Time To Make Changes?

JANUARY 14, 2013 VOLUME 20 NUMBER 2 Congress acted (not just at the last minute, but after the last minute). The update to the estate tax provisions is permanent, or at least what passes for permanent in the world of taxes and politics. So does that mean you need to make changes to your estate […]

I Just Want to Put My Daughter’s Name On My Deed

NOVEMBER 5, 2012 VOLUME 19 NUMBER 40 We hear that request all the time. “I want to make it easy for her when I die — just put my daughter’s name on the deed,” client after client insists. When we resist, they think we are acting too much like lawyers. There are no statistics out […]

LLC Interest Not Transferred to Trust During Life, is Subject to Probate

OCTOBER 8, 2012 VOLUME 19 NUMBER 37 Bear with us. This story will be a little dense and involve more difficult legal issues than we usually like to tackle. The good news: at the end you get an honorary law degree. Well, not really — but you’ll probably deserve one. Matt Silver (not his real […]

We Suggest Two Positive Things About Probate — But Not Too Vigorously

SEPTEMBER 24, 2012 VOLUME 19 NUMBER 36 Two weeks ago we wrote about why you might want to plan your estate with an eye toward avoiding probate. We hope you concluded, with us, that the probate process may not be as onerous as one would believe based on its bad reputation. We concluded with a […]

Is It Important to Avoid Probate? Why, or Why Not?

SEPTEMBER 10, 2012 VOLUME 19 NUMBER 35 Earlier this year we wrote about how to avoid probate. We told you at the time that we might later address whether to avoid probate. This week we’re going to tackle that topic. You might be thinking something like: “‘whether to avoid probate’? Isn’t that foolish? Of course […]

Claimant Must Prove Undue Influence, Lack of Capacity

AUGUST 27, 2012 VOLUME 19 NUMBER 33 It has been some time since we wrote about the concepts of undue influence and lack of testamentary capacity — and the differences between these two legal concepts. A recent Minnesota appellate case strikes us as a good opportunity to revisit challenges to wills and trusts based on […]